Easy to Find a Fast Online Payday Loan for Emergency Cash Money

Easy to Find a Fast Online Payday Loan for Emergency Cash Money

Blog Article

Secure Your Future With Tailored Online Loans From Specialist Lending Solutions

In today's ever-evolving and hectic monetary landscape, safeguarding your future typically calls for tactical preparation and educated decision-making when it comes to managing your funds. Customized online fundings offered by professional loan services have actually ended up being a preferred selection for people seeking monetary aid. These services not just offer comfort but also use tailored financing choices that cater to individual requirements and circumstances. Navigating the globe of on the internet car loans can be intimidating without the appropriate understanding and advice. By understanding the advantages, selecting the ideal service, understanding the problems and terms, and taking essential actions to protect your car loan, you can lead the method for a monetarily protected future. Yet how can you make sure that you are optimizing the capacity of your online funding to achieve long-term success? Allow's discover the vital methods and factors to consider that can help you take advantage of your customized on the internet funding and established yourself up for a flourishing future.

Benefits of Tailored Online Loans

Customized on the internet car loans use a myriad of benefits for individuals looking for individualized monetary solutions in today's electronic age. With on the internet finance services, consumers can use for financings from the comfort of their homes or workplaces, removing the need to see physical branches.

Furthermore, tailored on-line finances typically include quick authorization processes. By leveraging digital innovation, lenders can accelerate the confirmation and approval procedures, permitting consumers to gain access to funds in a timely fashion. This rapid turnaround time can be critical for individuals facing urgent monetary demands or unexpected costs.

Exactly How to Choose the Right Lending Service

Given the array of customized online funding options readily available today, selecting the best finance solution that lines up with your particular economic demands calls for mindful factor to consider and informed decision-making. To start, recognize your monetary goals and the function of the financing. Recognizing just how much you need to obtain and for what specific reason will certainly assist limit the options offered.

Next, contrast rate of interest prices, charges, and repayment terms from different funding solutions. In addition, assess the degree of customer assistance offered by the car loan solution, as having access to receptive assistance can be critical throughout the loan process.

Furthermore, evaluate the adaptability of the finance solution in regards to settlement navigate to these guys alternatives and prospective extensions. Ensure that the car loan service aligns with your economic capacities and provides a repayment strategy that suits your budget. By taking these factors into account, you can make a notified decision and pick the right funding service that ideal fits your economic demands.

Understanding Financing Conditions

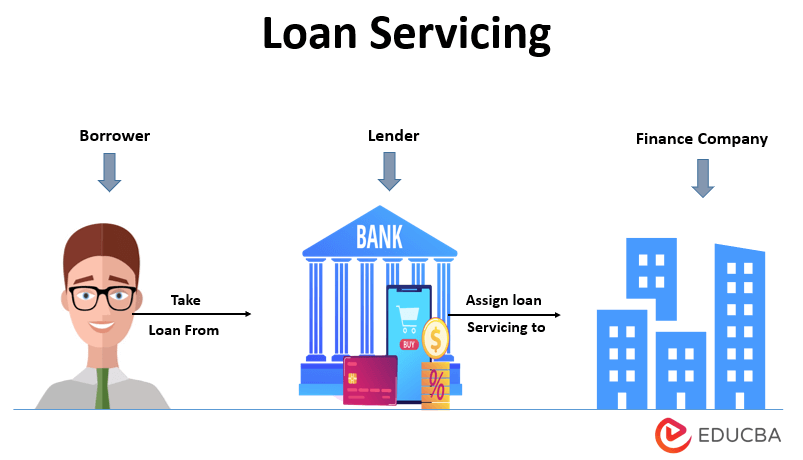

Recognizing the ins and outs of loan terms and conditions is essential for borrowers looking for to make well-informed economic choices. Finance terms describe the specifics of the contract in between the debtor and the loan provider, consisting anchor of the car loan amount, rate of interest price, settlement schedule, fees, and any type of various other pertinent information. Payday Direct Loans Online. It is crucial for customers to very carefully assess and understand these terms before consenting to a funding to prevent any type of surprises or pitfalls down the line

One secret facet of financing terms is the rate of interest, which figures out the cost of obtaining cash. Debtors must pay attention to whether the rate of interest is fixed or variable, as this can affect the overall amount paid off over the life of the loan. Additionally, comprehending any fees connected with the loan, such as origination charges or early repayment fines, is essential for budgeting and planning objectives.

Actions to Safeguard Your Online Loan

Prior to continuing with safeguarding an on the internet funding, borrowers need to first ensure they thoroughly understand the problems and terms laid out by the lender. It is critical to have these documents readily available to speed up the finance application process.

After gathering the required paperwork, consumers ought to look into various finance options available to them. Comparing rates of interest, settlement terms, and any kind of additional charges will certainly help borrowers make an educated decision - payday loan places in my area. As soon as a suitable financing alternative is picked, the application process can begin. This usually involves submitting an on the internet application form and submitting the essential papers for verification.

Maximizing Your Lending for Future Success

To leverage the full potential of your financing for future success, calculated monetary preparation is vital. Optimize the effect of your finance by thinking about the long-term effects of your monetary choices. In addition, discover ways to maximize your spending plan to fit loan repayments without compromising your monetary stability.

Final Thought

Finally, customized on the internet car loans from specialist lending services use numerous advantages for securing your future monetary stability. By carefully choosing the best finance service, understanding the conditions and terms, and adhering to the needed steps to guaranteed loans for bad credit protect your loan, you can maximize its possibility for future success. It is essential to come close to online finances with care and make certain that you are making informed choices to accomplish your economic objectives.

Report this page